On November 11, 2025, the German Federal Ministry of Finance introduced new rules for the tax treatment of self-paid electricity costs for charging electric company cars at home. The new guidelines also take into account charging with photovoltaic surplus and dynamic electricity tariffs. This creates new opportunities for companies and drivers to optimize costs and benefit from tax relief.

What applies from 2026?

The previous flat-rate reimbursement for charging ends on December 31, 2025. Starting January 1, 2026, the following rules apply:

Reimbursement only with proof:

- The amount of electricity charged must be recorded via a separate meter (stationary or mobile).

Determining the electricity price:

Individually based on the driver’s electricity contract (including base fee)

Alternatively, flat-rate based on the household electricity price for the first half of the previous year, published by the Federal Statistical Office

Option to choose:

- The chosen method applies for the entire calendar year. Switching is not allowed.

We’ve summarized everything you need to know: New rules for company car charging from 2026

Download our charge@home Guide now!

Our guide highlights the requirements for a home charging solution and explains what is needed to use it for legally compliant billing of company cars. Learn more about the installation of wallboxes, legal frameworks, and efficient billing solutions for home charging.

REQUEST GUIDE

Dynamic Electricity Tariffs

Anyone using a dynamic electricity tariff can apply the flat-rate reimbursement. This reduces effort and simplifies billing. Drivers also benefit from lower prices at certain times of the day.

Photovoltaic Surplus Charging

For owners of a photovoltaic system, the new regulation is particularly interesting. From 2026, the reimbursable electricity price can be:

Individually based on the household electricity tariff (purchase tariff), or

Flat-rate based on the official average price

What this means: If you charge your company car during sunny periods, you’ll receive a reimbursement higher than the feed-in tariff.

Example Calculation

Electricity from your own photovoltaic system can be used to charge the electric company car. The reimbursement is tax-free at the purchase tariff rate by the employer (see BMF letter dated 11.11.2025, para. 29).

Charged energy: 39 kWh

Reimbursement: €12.48 regardless of the actual energy mix

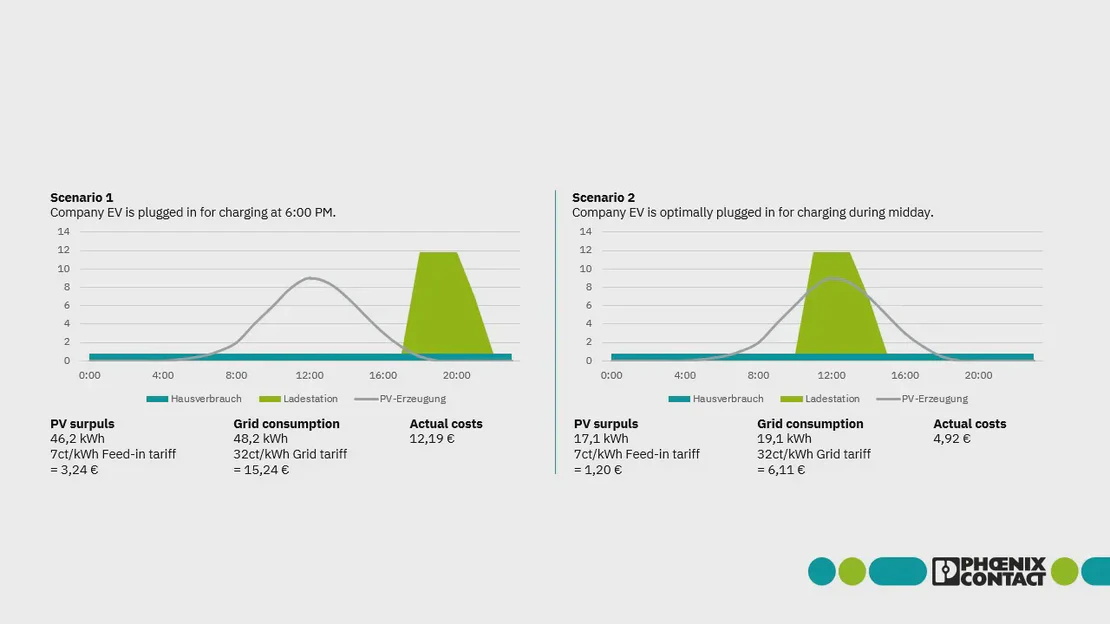

The graphic shows two scenarios:

Charging in the evening → Reimbursement: €12.48 vs. actual cost €12.19

Charging at midday (PV surplus) → Reimbursement: €12.48 vs. actual cost €4.92

Conclusion: Flexible charging saves money.

Technical Requirements

For dynamic tariffs and PV surplus charging, a wallbox integrated into an energy management system is required so that charging starts only at cost-effective times. There are currently no uniform standards for communication between wallboxes and energy management systems. Control is usually tied to the wallbox manufacturer. Replacing the wallbox for billing purposes is not practical.

The solution: With the Charge Repay Service, any wallbox can be used. Our patented retrofit metering hardware does not interfere with PV surplus charging or dynamic tariff control. The existing infrastructure remains intact, and billing is legally compliant.

Why act now?

The new regulations apply from 2026. Companies should adapt their processes early to take advantage of tax benefits and offer employees a simple, transparent solution.